The automotive financing landscape is filled with diverse choices, with the balloon payment under Personal Contract Purchase (PCP) agreements being prominent.

Deciphering the Balloon Payment

In the PCP model, the balloon payment is the significant sum that concludes your finance term if you purchase the vehicle. Unlike standard monthly instalments, this hefty sum is both substantial and optional.

Example:

Let's assume you're eyeing up a £30,000 vehicle finance deal - though by engaging with Motorfinity; you might reduce this figure somewhat. If the balloon (residual) payment is set at £15,000, you're essentially paying interest on £15,000 throughout the loan. The £15,000 due as the balloon payment is settled when the contract ends.

The balloon payment is not a random figure, nor is it a flexible one. The lender calculates the balloon payment at the outset of your agreement, basing it on the vehicle's Guaranteed Future Value (GFV). Essentially, the GFV is the resale value the lender anticipates your vehicle will hold at the culmination of your contract.

Once set, your balloon payment remains fixed throughout the agreement, irrespective of any fluctuations in used car values.

End of Term Choices With Balloon Payments

There are three choices at the end of the term with balloon Payment

Conclude the Purchase:

Think of settling the balloon payment like completing a puzzle; once the last piece (balloon payment) is in place, the vehicle becomes entirely yours.

When is this the more suitable option?

Venture Into a New Contract:

The second choice is to venture into a new contract. This can mean either refinancing the current vehicle or getting a new one.

When is this more suitable option?

Hand Back the Keys:

If the above options aren't enticing, simply return the vehicle.

When is this the more suitable option?

Scenarios in Which Balloon Payment is Most Suitable

There are various scenarios in which Balloon Payment can be vital, especially when comparing it with other car finance options such as Hire Purchase or Loan. Here are the following scenarios

Balloon Payment in the Context of Inflation:

When you consider inflation, a balloon payment might be a better choice. If inflation goes up, money in the future won't have as much buying power as it does now. This means that a large balloon payment could cost you less in today's money than it seems. This makes the initial smaller payments of a PCP quite attractive, especially when you stack it up against hire purchase deals.

Managing Your Cash Flow:

For those who like to keep more money on hand in the short term, a balloon payment PCP might be the best fit, especially when compared to a hire purchase or other loans. This choice gives you more wiggle room to handle your different financial needs and opens up more chances to invest. Some people prefer the smaller monthly payments because they can put that money to work elsewhere, hoping to earn more than they pay on their loan interest.

The Issue of Depreciation:

New vehicles tend to depreciate rapidly. When your balloon payment is due, the car's value could be significantly lower than the remaining balance. In such situations, a balloon payment can be the ideal choice. Read on for a deeper dive into this relationship.

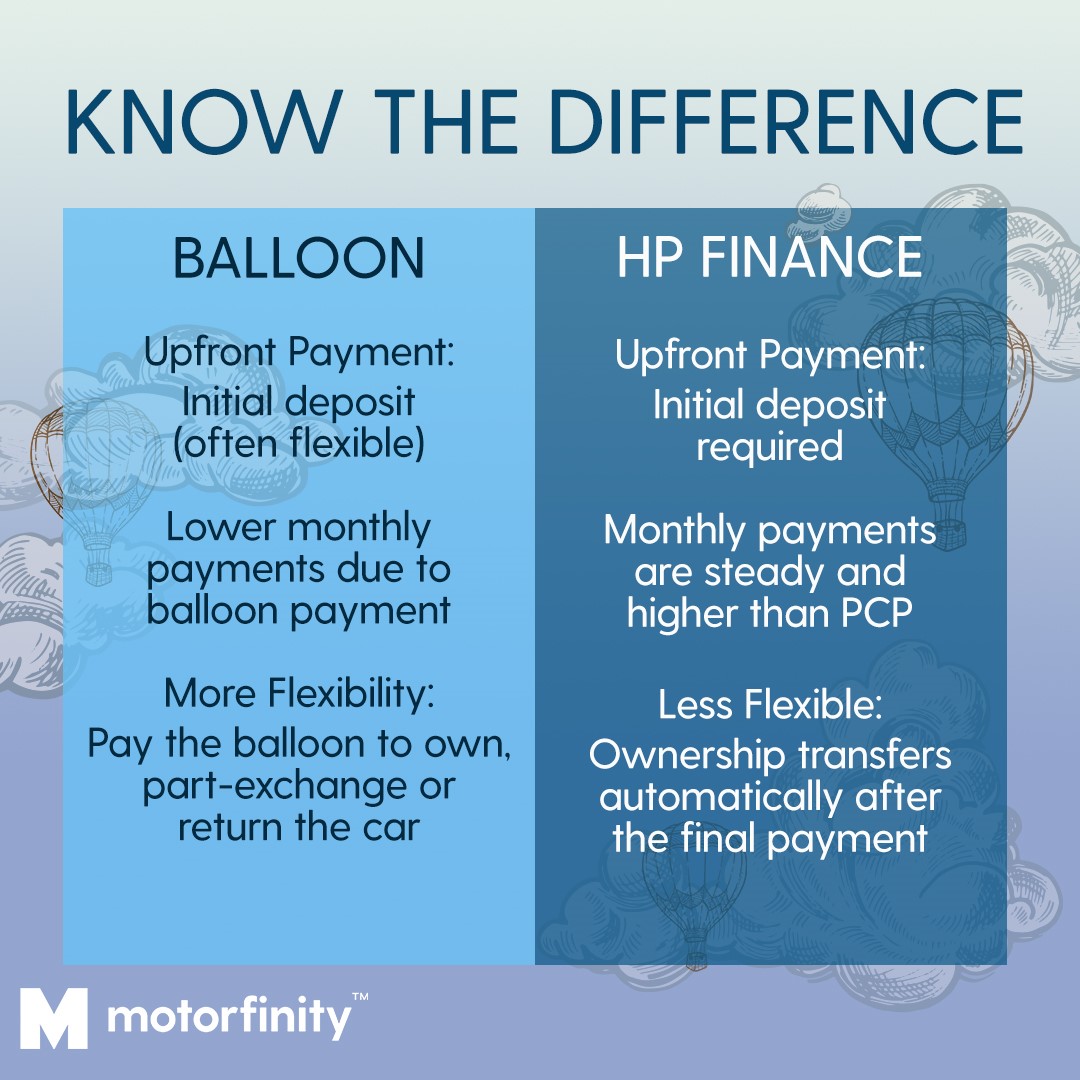

Balloon Payment Option vs Hire Purchase

The choice between the balloon payment and the hire purchase largely depends on individual financial situations, preferences, and risk tolerance. Balloon payments can be attractive for those seeking lower monthly payments and potential flexibility at the contract's end.

In contrast, hire purchase provides more straightforward ownership progression and predictable costs but might come with higher monthly outlays.

For a nitty-gritty look at the differences, have a gander at our in-depth article on difference between PCP and HP.

Balloon Payment: The Two Sides of the Coin

Pros:

• Stable Monthly Expenditures: A prominent balloon payment often translates to predictable, and lower monthly costs.

• Versatility at Contract End: The PCP model offers a buffet of options as the contract terminates.

Cons:

• A Daunting Final Sum: The lump-sum nature of the balloon payment necessitates strategic financial preparation.

• Depreciation Hazards: With the balloon payment being constant, swift depreciation of the car's market value can hint at potential financial pitfalls.

Balloon Payments and Depreciation

The balloon payment's magnitude is intricately linked to the anticipated depreciation of the car. When crafting a PCP deal, the financier’s prediction of the car's end-of-term value – the GMFV – plays a pivotal role. This forecast hinges on various influencing factors.

For consumers, this projection has tangible repercussions:

1. Consistent Balloon Payment: Regardless of market fluctuations, the balloon payment remains steadfast.

2. Options at Term's End: An unexpected depreciation rate can influence your end-of-term decisions, especially if the car's market value dips below the GMFV.

3. Equity Potential: A market value above the GMFV can be leveraged for subsequent vehicle negotiations.

In Conclusion

Balloon payments, characterised by their flexibility and challenges, remain a notable option in the automotive finance sphere. To truly capitalise on their benefits, knowledge and meticulous planning are indispensable.